Introduction to Cryptocurrency Investment

The world of cryptocurrency has seen a meteoric rise in recent years, attracting both seasoned investors and newcomers alike. Cryptocurrency investment offers a unique opportunity to diversify portfolios and potentially earn high returns. However, it is crucial to understand the risks and rewards associated with this emerging asset class before diving in. In this article, we will explore the basics of cryptocurrency investment, its potential benefits, and the factors to consider when making investment decisions.

Understanding Cryptocurrency

Cryptocurrency is a digital or virtual currency that uses cryptography for security. Unlike traditional fiat currencies, cryptocurrencies are decentralized and operate on a technology called blockchain. This technology ensures transparency, security, and immutability of transactions. Bitcoin, the first and most well-known cryptocurrency, was launched in 2009, followed by a plethora of other altcoins like Ethereum, Litecoin, and Ripple.

Benefits of Cryptocurrency Investment

There are several reasons why investors might consider adding cryptocurrency to their portfolio:

High Potential Returns: Cryptocurrencies have historically offered high returns, with some coins experiencing exponential growth in value.

Diversification: Investing in cryptocurrencies can help diversify a portfolio, reducing exposure to traditional asset classes like stocks and bonds.

Accessibility: Cryptocurrency markets are accessible 24/7, allowing investors to trade at their convenience.

Innovation: The blockchain technology underpinning cryptocurrencies has the potential to revolutionize various industries, including finance, healthcare, and logistics.

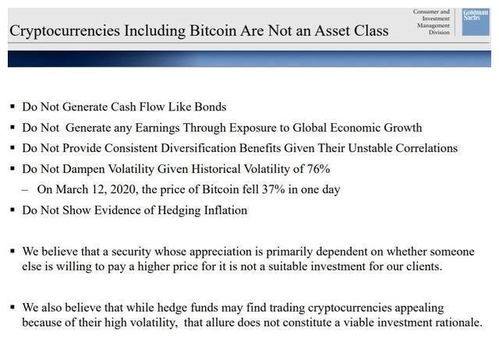

Risks of Cryptocurrency Investment

While the potential benefits are enticing, it is essential to be aware of the risks involved in cryptocurrency investment:

Market Volatility: Cryptocurrency markets are known for their extreme volatility, with prices often skyrocketing or plummeting rapidly.

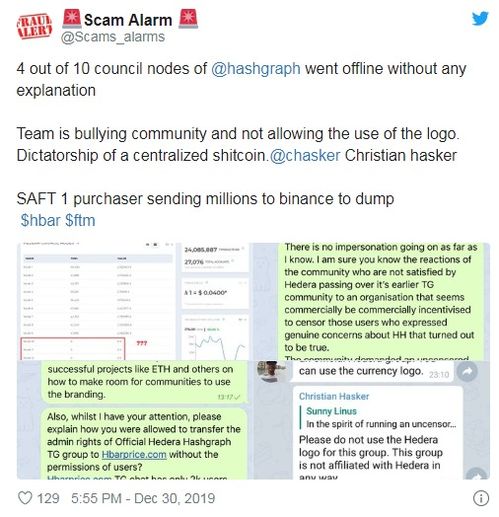

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, which can lead to sudden changes in market dynamics.

Security Risks: Investors must be vigilant about the security of their digital assets, as hacks and thefts are not uncommon.

Lack of Consumer Protection: Unlike traditional banks, cryptocurrency exchanges do not offer the same level of consumer protection, making it crucial to conduct thorough research before investing.

How to Invest in Cryptocurrency

If you decide to invest in cryptocurrency, here are some steps to consider:

Research: Educate yourself about the various cryptocurrencies available, their market potential, and the teams behind them.

Choose a Cryptocurrency Exchange: Select a reputable cryptocurrency exchange that offers the coins you are interested in trading.

Understand the Trading Platform: Familiarize yourself with the trading platform's features, fees, and security measures.

Set a Budget: Determine how much you are willing to invest and stick to it to avoid making impulsive decisions.

Keep Your Assets Secure: Use secure wallets and consider enabling two-factor authentication to protect your investments.

Conclusion

Cryptocurrency investment can be a lucrative venture, but it requires careful consideration and research. By understanding the basics of cryptocurrency, its potential benefits, and the risks involved, investors can make informed decisions and potentially capitalize on the opportunities this emerging asset class offers. As with any investment, it is crucial to only invest what you can afford to lose and to stay informed about market developments.

Tags: CryptocurrencyInvestment Blockchain DigitalCurrency InvestmentRisks CryptoMarket CryptoTrading CryptoExchanges CryptoSecurity